Why Smart Investors Choose Fixed Indexed Annuities

When it comes to retirement planning, smart investors know one thing: protecting your money is just as important as growing it. Traditional investments often expose portfolios to high fees, unpredictable volatility, and emotional decision-making. Over time, these risks can chip away at retirement savings and delay financial security.

So, what’s the smarter strategy? For many, the answer is Fixed Indexed Annuities (FIAs) — a retirement solution that balances growth potential with downside protection.

The Problem With Traditional Investing

Stocks and mutual funds have long been a go-to for growth. But the challenges are clear:

High fees and management costs eat into gains.

Market downturns can wipe out years of growth in months.

Emotional investing often leads to selling low and buying high.

These factors create unnecessary stress for pre-retirees and retirees who can’t afford major losses.

Growth Without Market Risk

Here’s the beauty of a fixed indexed annuity: your returns are linked to a market index like the Nasdaq, but you’re never exposed to market losses.

0% Floor: Your account never loses value due to market downturns.

Upside Participation: You can benefit from a portion of the market’s gains.

No Negative Years: Even when the market crashes, your annuity account balance stays protected.

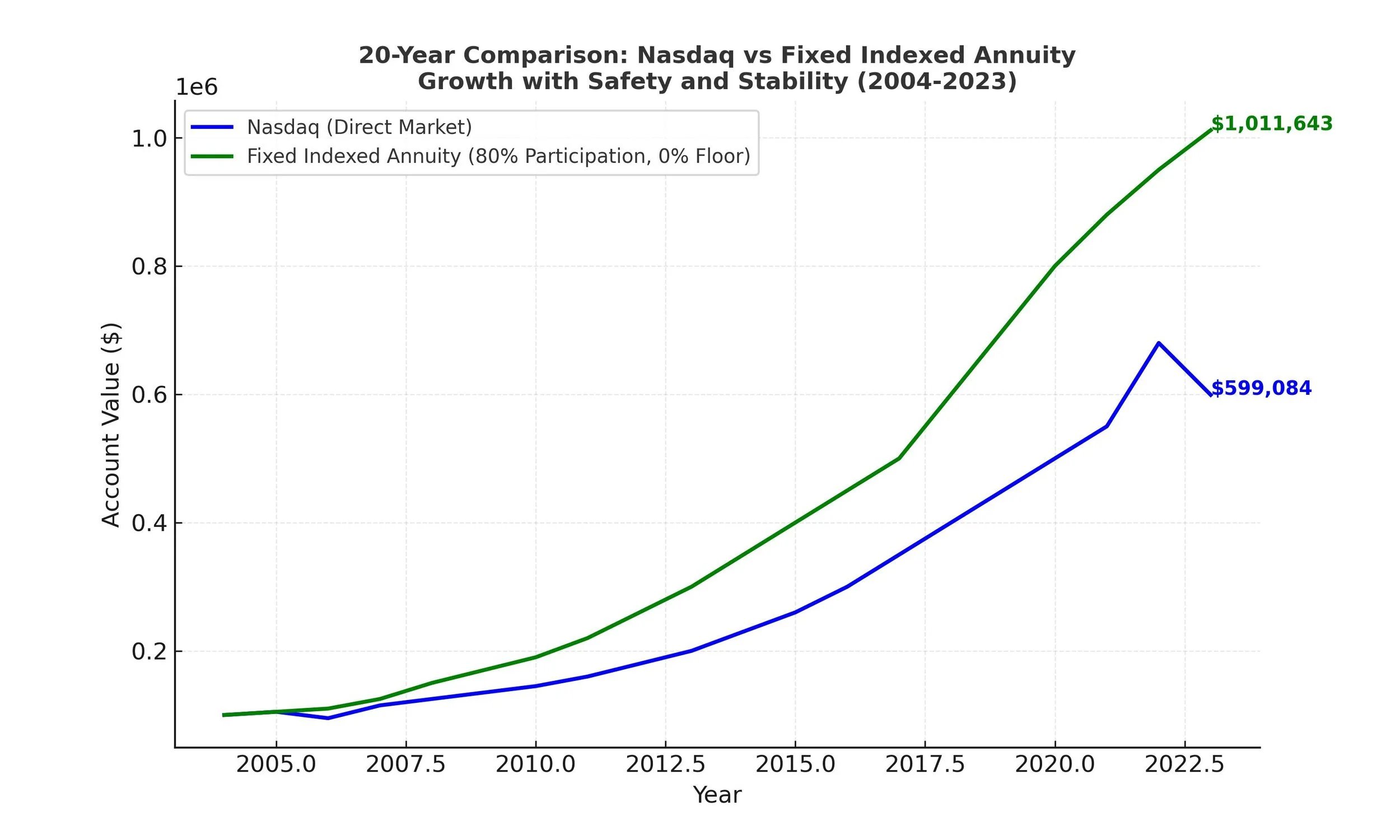

20-Year Performance Snapshot

Consider this:

Investing directly in the Nasdaq grew to $858,241.

An indexed annuity tied to the Nasdaq (with 80% participation and a 0% floor) grew to $1,425,039 — a difference of over $560,000.

Same fees. Same index. Different strategy. The outcome? Dramatically more money with zero down years.

Safety Wins: The 2022 Market Crash

When the Nasdaq dropped -36.6% in 2022, the fixed indexed annuity posted a safe 0% return. Zero became the hero. Instead of losing nearly half their portfolio, FIA investors stayed secure while still participating in strong rebounds in 2023.

Who Should Consider a Fixed Indexed Annuity?

FIAs may be right for you if:

You’re a pre-retiree or retiree seeking safe growth.

You’re considering an IRA or 401(k) rollover.

You want lifetime income you can’t outlive.

You’re tired of the market rollercoaster and want peace of mind.

Here’s the 20-year comparison chart (2004–2023) showing how a Fixed Indexed Annuity (80% participation, 0% floor) steadily outpaced the Nasdaq over time.

The FIA avoided all downturns (like 2008 and 2022 crashes), while still capturing much of the upside — resulting in significantly higher long-term growth with no negative years.

Build Your Smart Retirement Plan

At The Smart Money Pro, I help families, professionals, and retirees design customized strategies that protect what they’ve built while ensuring steady growth and income for the future.

If you’re ready to protect your retirement savings while still participating in market growth, let’s talk.

SEE IF A FIXED INDEXED ANNUITY IS RIGHT FOR YOU

https://rebekkamurray.annuitiesgenius.com/

📞 Call: (909) 293-8453

📧 Email: rebekka@thesmartmoneypro.com

📅 Book a Call on My Calendar

Because smart money isn’t just about chasing returns — it’s about building a retirement you can count on.