The Power of Compounding Interest and the Rule of 72 (How to Win Over Credit Cards and Debt)

If there’s one financial concept that can change the way you think about money forever, it’s this: compounding interest is your best friend—or your worst enemy.

Albert Einstein is often quoted as calling compounding interest “the eighth wonder of the world.” Why? Because it has the power to quietly multiply your money (or your debt) over time, without you lifting a finger.

Let’s break it down.

What Is Compounding Interest?

Compounding interest is when your money earns interest, and then that interest earns interest, and so on. It’s growth on top of growth.

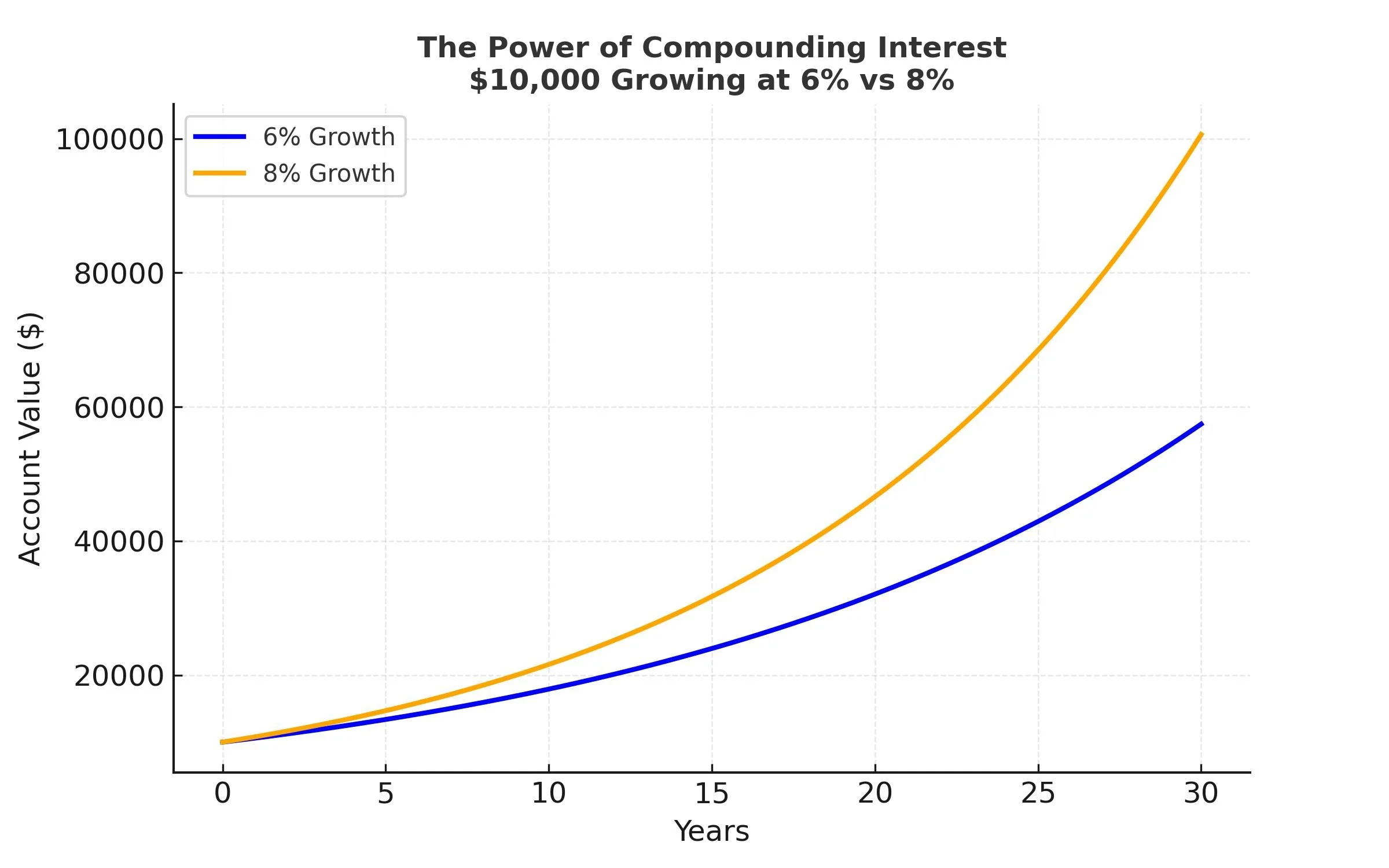

If you put $10,000 into an account earning 6% annually, in one year you’d earn $600.

The next year, you don’t just earn 6% on $10,000—you earn 6% on $10,600.

Over time, that snowball effect becomes massive.

With compounding, time matters more than the amount you start with. The earlier you start, the more powerful compounding becomes.

Enter the Rule of 72

The Rule of 72 is a simple mental shortcut to estimate how fast your money will double.

Here’s how it works:

Divide 72 by your annual rate of return.

The result is the approximate number of years it will take your money to double.

Example:

If you’re earning 6%, 72 ÷ 6 = 12 years to double

If you’re earning 8%, 72 ÷ 8 = 9 years to double.

That means at 8% growth, your money doubles about every 9 years. Start with $50,000 → $100,000 in 9 years → $200,000 in 18 years → $400,000 in 27 years. That’s the magic of compounding at work.

Why It Matters to You

The Rule of 72 is simple, but it has big implications:

Starting early pays off. The earlier you put money to work, the more doubling cycles you capture. Waiting even a few years can cost you hundreds of thousands of dollars.

Your rate of return matters. Even a small difference in return can mean years off your doubling timeline.

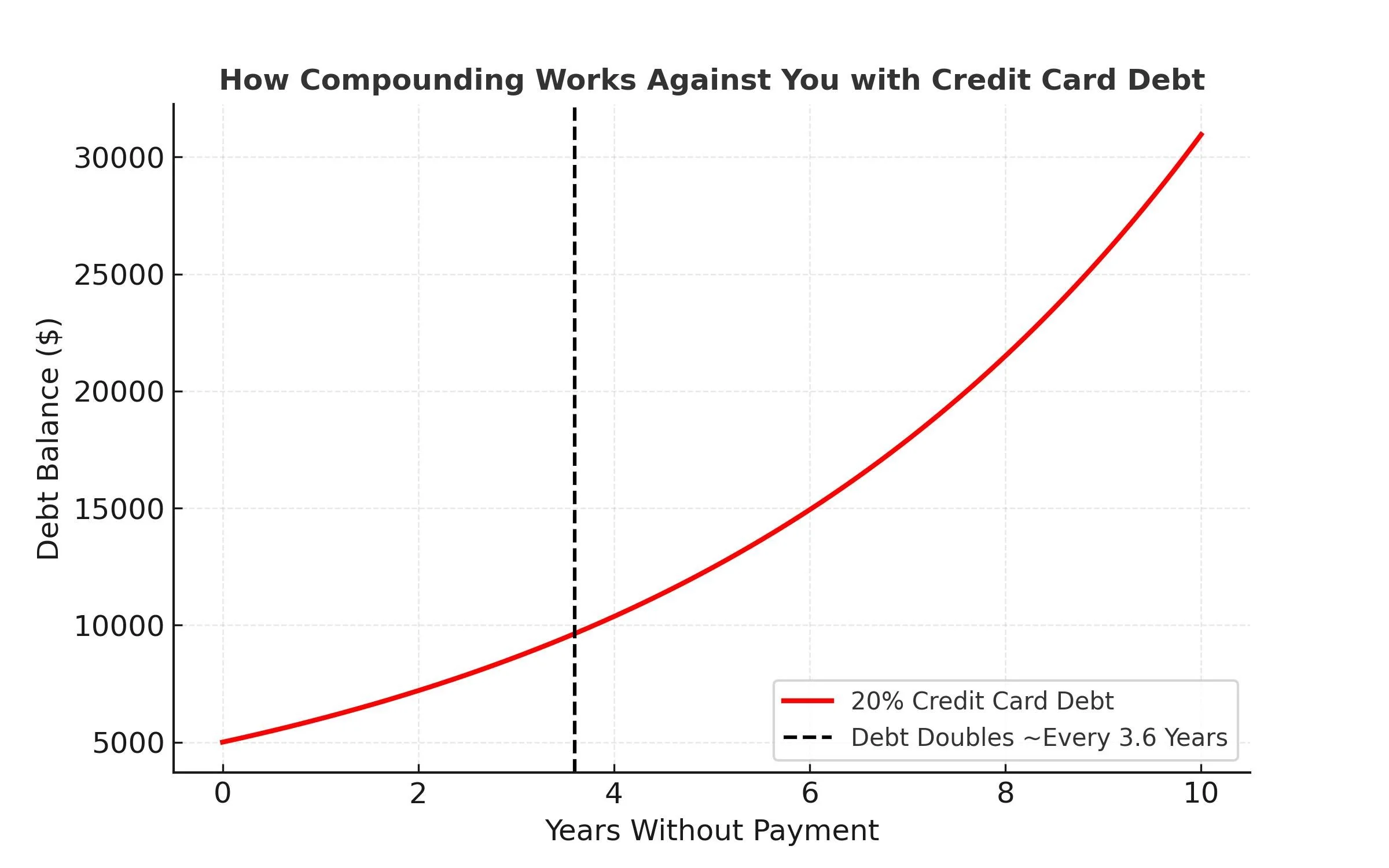

Debt works the same way—but against you. High-interest debt like credit cards double your balance quickly, which is why paying them off is so important.

Putting It Into Action

The power of compounding isn’t just for Wall Street—it’s for everyday families. Whether it’s retirement accounts, college plans for kids, or safe alternatives like indexed annuities and cash value life insurance, there are ways to harness this power for your future.

The key? Start now. Even if it’s small, time and consistency turn small dollars into big dollars.

✨ If you’d like help running the numbers for your own goals—whether it’s retirement, kids’ education, or building wealth for the long term—I’d love to show you how compounding interest can work in your favor.

If you want to learn how to effectively eliminate debt and save money at the same time, reach out and start moving towards being debt free!

📞 Call: (909) 293-8453

📧 Email: rebekka@thesmartmoneypro.com

📅 Book a Call on My Calendar